COMMUNITY INVESTMENT TAX CREDIT

CITC Program 2024

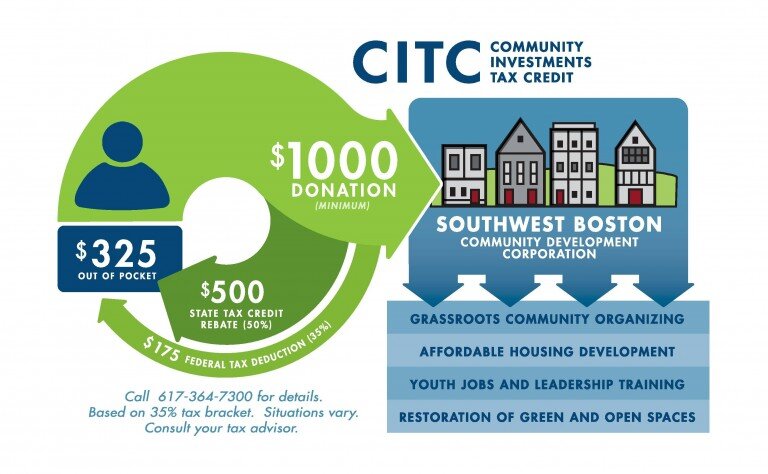

Your donations through the Community Investment Tax Credit Program have a tremendous impact on community development projects, but a smaller impact on your wallet. CITC Donations are eligible for 50% state tax credit or refund. The CITC program is open to individuals, businesses, foundations and other non-profits both in and out of MA. Donations of $1,000 or more are eligible for Massachusetts tax credit up to 50 percent of the donation.

Click here to make any donation! Please call us at 617-364-7300 if you have any questions!

Southwest Boston CDC is a 501(c)(3) organization. Our federal tax ID is 04-3562853. Your contribution is tax exempt to the fullest extent of the law. Special thanks to Graphic Designer Matt Smith for his pro-bono work to design the info graphic above.